Master Your Money: A Simple Guide to Budgeting for Financial Freedom

Budgeting isn’t just about dollars and cents. It’s about creating a life where you control your money—not the other way around. With a little planning, discipline, and consistency, you can transform your financial habits and unlock the freedom to pursue what truly matters.

Millions of people live paycheck to paycheck, constantly feeling the pressure of financial stress. But one of the most effective ways to reduce that stress is also one of the most overlooked: budgeting. Contrary to popular belief, budgeting doesnt mean cutting out all fun or becoming a money-obsessed spreadsheet wizard. It simply means giving your money direction and purpose.

When you understand where your money is going, you can make smarter choices, avoid common financial pitfalls, and work toward real financial stabilityeven freedom.

Why Budgeting Matters More Than You Think

If you dont know where your money is going, its easy to lose control. A budget acts like a map, guiding your financial decisions and helping you stay on course. Heres what a simple budget can help you do:

-

Track your spending habits

-

Identify and reduce unnecessary expenses

-

Save more consistently

-

Stay out of debt

-

Plan for the unexpected

Even a basic budget can reveal insights that lead to big improvements.

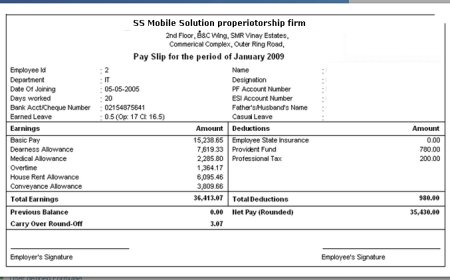

Step 1: Know Your Real Income

Before you can plan your spending, figure out how much money you actually have available. This means calculating your net incomethe amount you take home after taxes, insurance, and retirement deductions.

Include all sources of income:

-

Wages or salary

-

Side hustles

-

Freelance gigs

-

Rental income

-

Child support or alimony (if applicable)

Budgeting based on gross income (before deductions) is a common mistake that can throw your numbers off.

Step 2: Track and Categorize Your Spending

Understanding where your money goes is essential. Start by reviewing your last 23 months of bank and credit card statements. Break your expenses into categories:

-

Fixed costs: Rent, mortgage, utilities, subscriptions

-

Variable costs: Groceries, fuel, phone bills

-

Discretionary spending: Restaurants, hobbies, online shopping

-

Financial goals: Savings, investments, debt repayment

You might discover that small, frequent purchaseslike snacks, subscriptions, or even vape juice online from the best online vape storeadd up more than you expected.

Step 3: Pick a Budgeting Strategy That Fits You

Theres no perfect budgeting methodonly the one that fits your lifestyle. Consider these options:

1. 50/30/20 Rule

-

50% for needs

-

30% for wants

-

20% for savings and debt repayment

Its ideal for beginners and provides flexibility while encouraging balance.

2. Zero-Based Budget

Assign every dollar a job. At the end of the month, your income minus expenses equals zero. Nothing goes unaccounted for.

3. Envelope Method

Allocate physical or digital envelopes for each spending category. When an envelope is empty, that category is done for the monthno exceptions.

Whichever method you choose, stick with it for at least 23 months to get into a rhythm.

Step 4: Set Financial Goals That Motivate You

Why are you budgeting? Setting specific goals makes it easier to stay focused and resist impulse buys.

Examples include:

-

Paying off high-interest debt

-

Building a 36 month emergency fund

-

Saving for a vacation, home, or education

-

Investing for retirement

Clear goals bring purpose to your budget and keep you committed. Even saving a few extra dollars by choosing affordable vapes online instead of retail options adds up over time.

Step 5: Review and Adjust Regularly

Your budget should evolve with your life. A change in job, rent, or lifestyle means your numbers need updating. Plan to check your budget monthly.

Use budgeting tools and apps to make tracking easier:

-

Mint

-

YNAB (You Need A Budget)

-

Goodbudget

-

PocketGuard

These apps connect to your bank and help keep you accountable.

Step 6: Save Without Feeling Deprived

Budgeting doesnt mean cutting out everything you love. The trick is to spend smarter.

Here are simple ways to cut costs:

-

Cancel unused streaming services

-

Make coffee at home

-

Meal prep instead of dining out

-

Use price comparison tools before buying

-

Carpool or take public transportation

You dont have to stop enjoying lifeyou just have to plan for it.

Step 7: Stay Accountable and Celebrate Wins

Money goals can feel overwhelming. Having someone to talk towhether its a partner, friend, or online communitycan help keep you on track.

Most importantly, celebrate progress, no matter how small:

-

Paid off a credit card?

-

Saved your first $500 emergency fund?

-

Stuck to your budget for the entire month?

Reward yourself (responsibly). Maybe with a low-cost treat or a product youve been eyeing, like something from your favorite best online vape storeas long as it fits within your plan.

Final Thoughts: Budgeting Is Empowerment

Budgeting isnt about saying noits about saying yes to the things that truly matter. Its about understanding your limits so you can push past them in the right way.

You dont need to be a financial expert to take control of your money. All it takes is the willingness to start, the discipline to stay consistent, and the flexibility to adjust when life changes.

Start simple. Be honest. Stay consistent. Thats the path to financial peace of mind.